Could laws prohibit people and corporations from taking advantage of citizens?

In Regards to Healthcare and Health Insurance

There are already a number of laws that are designed to protect citizens from being extorted by corporations. The Food and Drug Administration was set up for this exact reason, and it's chock full of laws that are designed to stop pharmaceutical companies from selling snake oil to citizens. The best way to describe what the effects of laws designed to help protect citizens do to the healthcare industry is to describe the process in which a new drug is created and put on the market. For the sake of this post I'll play with a hypothetical that the pharma company, Pfizer Inc. is looking to develop a new drug (which they most likely are). As you read, understand that Pfizer is definitely not my favorite company in the world, but using them for this hypothetical can help place the drug market in a more popular mindset since they're one of the most successful drug companies out there.

So, in 2010 Pfizer sued another company called Teva Pharmaceuticals over a case where Teva had announced that they were going to introduce a generic version of Viagra to the market. This is illegal, since Pfizer owns a patent, and therefore any molecule that could be related to the molecular construction of Viagra can't be sold until Pfizer's patent expires. Luckily for Teva, Pfizer decided to sell the company an early royalty license to make and sell Viagra after the lawsuit for an undisclosed amount of money. Although the patent for Viagra doesn't expire until April of 2020, Teva's generic version of Viagra is expected to hit the market on the 11th of December, 2017.

When a patent expires for a drug company, this is great news to the consumer market. When a drug company owns a patent for a drug, the company owns a monopoly over that disease that the drug treats, especially if the drug that the company is selling is the best drug available or if it's the only drug available for its particular disease or treatment. When the patent expires, other pharma companies are now able to create legal alternatives of said drug for much less and therefore market the drug for much less.

This patent system was created so that when a drug company invents a new molecule for medical treatment, they will have intellectual property rights on their invention. The idea is that the company deserves to profit off of it's hard work after spending the time and money to research and develop a successful, new drug (which I'll explain later). The problem with this system is that the pharmaceutical company will have a static market of that disease for the next twenty years due to the patent's protection. Unfortunately, there will always be erectile dysfunction, and because of that there will always be a demand for a good drug to treat the dysfunction. When a company holds control over a static market without competition from other companies, the price set for the drug is entirely in the hands of the pharma company, and when that happens a company like Pfizer will slowly increase the price of their patented drug until they notice a drop off of sales.

Here are two graphs from a Bloomberg article where list prices and negotiable prices (prices that pharmacies and other pharma distributors can negotiate for; estimates by SSR Health, a pharmaceutical advisory company) from 2015 were compared with their prices from 2009;

For Viagra and Cialis, which is manufactured by Eli Lilly and Co., it's clear that there was an unnecessary increase of price.

When one company controls a market, it is allowed to price-gouge to its heart's content. Although the market for erectile dysfunction is ultimately static, it is still a little more flexible than other drug markets. There would have eventually been a price set where men looking for help would have turned to alternate treatments. This form of price-gouging is much more sinister when a consumer literally cannot live without their treatment.

This is a graph from the same Bloomberg article that outlines the price increase for Avonex, which is a medicine that treats relapsing multiple sclerosis through an injection method similar to the Epipen;

From an amoral business standpoint, there isn't a market more profitable than the sick and dying.

So it seems like drug companies raise the price of their drugs exponentially towards the end of their patent protection. Does this mean that they are trying to extort and take advantage of the American people? Not exactly. There's actually a very clear and morally confusing reason as to why drug companies try and get the most out of their drug while the patent is still under federal protection. To go back to Pfizer, now that generic Viagra will soon be on the market, the pharma company is expecting an incredible loss of profit, like for example when Pfizer lost patent protection of Lipitor, a cholesterol drug, and lost over $4 billion in revenue.

In order for Pfizer to keep growing as a company, they'll need to make another successful drug and get it on the market quick. The process here begins by in Pfizer's research and development labs.

First, Pfizer needs to start inventing as many molecules as they can. The potentiality of malignant side effects at this stage doesn't matter, since testing won't begin until later. The problem here is that most molecules made at this stage have an incredibly poor chance of ever making it to testing. If the molecules do get to undergo clinical trials, they are still plagued by an incredibly low chance of getting on the market since "95% of the experimental medicines that are studied in humans fail to be both effective and safe." By the time that a molecule does prove to be safe and effective, a drug company could have already spent $350 million out of pocket according to Forbes, but this 2014 study from the Tufts Center for the Study of Drug Development, the average amount of money paid by a pharmaceutical or biotech company for research and development of a new drug or treatment was $1.395 billion (about $1.43 billion in 2016 when including inflation). To make matters worse, all of this money could be spent on multiple molecules undergoing testing which will increase the research and development cost, and this doesn't always guarantee that the drug will approve FDA post-approval testing, or if the drug will even be approved by the FDA at all.

At this point, Pfizer could be spending billions of dollars on research for drugs that will be shot down immediately by the FDA with only the hope that at some point something will pass through. Although Pfizer is one of the most successful pharma companies on the market, this cost is still unsustainable, and the company will have to seek out the help of investors to continue its research. Looking again at the Tufts study, the average cost of expected returns on investments for a pharma or biotech company's research and development for one drug is about $1.163 billion (about $1.192 billion in 2016 when including inflation). Just to keep track of costs, Pfizer, in accordance to the data from the Tufts study and the estimated inflation (here is the calculator I am using), would be spending around $2.622 billion for the research and development of only one drug. In regards to the ultimate goal of getting a new, profitable drug on the market, Pfizer will be spending this amount of money on multiple experimental drugs at a time, which makes everything even more expensive.

What's incredibly maddening is that these tests are necessary for the increasing expectations of the FDA pre-approval process. The guidelines are continuously becoming stricter, and although one could argue that the rules are necessary, they are directly impacting the extreme cost of developing new drugs. As soon as a drug undergoes the testing that meets these guidelines, a drug company will have to submit an Investigational New Drug (IND) application and wait for approval to continue clinical testing under the guidance of the FDA. There are three different types of IND's that vary in their level of emergency, for example a life saving cancer treatment might apply for an Emergency IND which can approve the drug for immediate use, but in Pfizer's case they most likely will apply for a research IND, which can take months. For example, generic drugs seeking approval will most likely apply for an Abbreviated ND application (ANDA), which in 2014 had a median wait time of 48 months for processing. In 2015, the FDA had a backlog of over 3,000 ANDA's to process, and they only approved 75 ANDA's in 2015 and 85 in 2014. The idea that a Pharma company has to spend $2.622 billion with such a slim chance of FDA approval is astounding, especially since the companies are required by law to follow these guidelines in order to get their drugs on the market.

Fortunately for Pfizer, getting investors to contribute to their research to pay these costs will be very easy. They are a majorly successful corporation that makes prescription medicine for illnesses that are generally more common than others, which means if and when they put another drug on the market, there will be profit. For smaller companies that are only researching one drug, its common that investors won't be interested until that drug has a successful IND application. What this means is that if a small start-up drug company discovers a molecule that could be a revolutionary cure for cancer, investors might not be interested in the cure and the company will have to prepare to spend hundreds of millions of dollars before they're granted any kind of profitable recognition; however, even if the small company gets investors to contribute, the drug could still be denied by the FDA. For small companies that are researching treatment for rare diseases, investors probably won't invest at all unless the price of the drug is incredibly high. If a company is trying to make a drug to treat a disease that only 50,000 people have, the price of the drug needs to be set so that the revenue can at least match the $2.622 billion price tag. Then the company needs to factor in manufacturing costs, administrative costs, and a reasonable amount of profit so that the company doesn't go under and cease the manufacturing of the drug.

Hopefully at this point Pfizer has gotten to the point where it has received an INDA for it's new drug. They're so close to getting the drugs in the hands of those who need it! The only issue is that Pfizer now must put the new drug through additional "studies to test new indications, new formulations, new dosage strengths and regimens, and to monitor safety and long-term side effects in patients required by the U.S. Food and Drug Administration as a condition of approval." The Tufts study states that these additional studies will add on another $312 million (about $320 million in 2016 when accounting for inflation) to the cost of post-approved production of the drug. Keeping track of long-term side effects is definitely something that will benefit the average American citizen, but required study for new dosage strengths and regimens, new indications, and new formulations is absolutely unnecessary. At this point in the production of the drug, it has undergone at least two years worth of testing, and the company should already be held responsible for accurate dosage strengths and appropriate treatment regimens. To continue, monitoring long-term side effects is not something that should cost millions of dollars, as it's nothing more than data collection.

If all of the costs are added up together, Pfizer at this point should have paid $2.942 billion for the research and development of their new drug, but that number would only be believable if Pfizer had been incredibly successful with their initial research and only had to account for a few molecules to undergo testing. In reality, Pfizer paid $7.779 billion per drug in 2013 with a total research and development cost of $77.786 billion over a ten year period (meaning at least one drug was produced for $7.779 billion each year), according to this data analysis from Forbes.

Now Pfizer is at the point where their drug is on the market, and the sales are coming in steadily as more and more people buy their drug. To see how well this works, let's look at a real world example. In 2005, Pfizer introduced Macugen, Revatio, Zmax and Lyrica to the market. In 2004, Pfizer paid $7.684 billion in research and development along with $7.442 billion in 2004. In 2004 and 2005, Pfizer made a profit of $304 million for Lyrica, $1.786 billion for Macugen (a figure which also includes their other medicines used for treatment of Alzheimer), $3.876 billion for Zmax. In total, Pfizer made $5.966 billion off of their three new drugs, but spent an approximated $8 billion leading up to their release to the market.

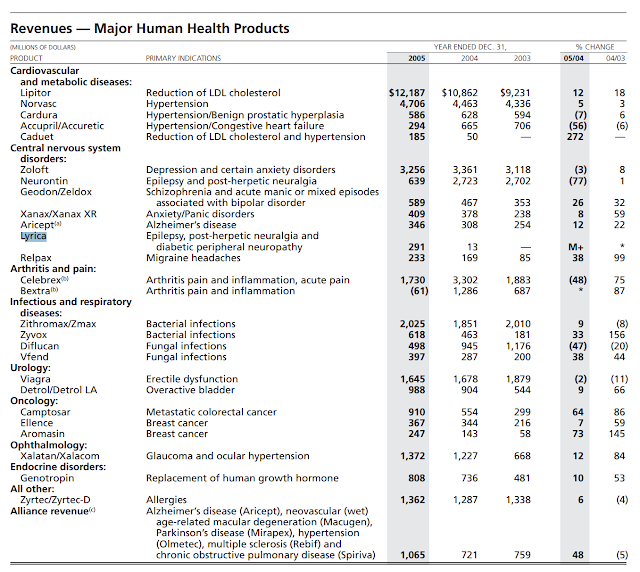

While analyzing a report of the revenues of Pfizer's major health products, we can see that they rely on certain products to fund the production of other products.

I deliberately left out the revenue for Revatio, since it isn't stated in this report. Revatio is a drug used to treat Pulmonary Arterial Hypertension, which affects less than 200,000 people a year, meaning that Pfizer wouldn't consider it a "major human health product."

Another thing I'd like to point out is that Revatio is the brand name of Sildenafil. This is important to point out because Viagra is also a brand name of Sildenafil, but Pfizer sells them with two different names. This is because in order for Pfizer to sell a drug that has the potential to treat multiple ailments or diseases, they have to submit a different INDA for the separate areas of treatment to the FDA for approval, and then follow the similar post-approval studies guidelines for the different brand names of the drug. For a brief side history of Viagra, Sildenafil was first patented by Pfizer in 1992 to treat cardiovascular diseases, and later patented again in 1998 for the treatment of erectile dysfunction. Pfizer started selling Viagra before Revatio hit the market, but by now the patent for Revatio has already expired. This means that generic Sildenafil (and in essence generic Viagra) has been on the market already for four years, but in doses appropriate for treating Pulmonary Arterial Hypertension instead of Viagra (meaning one would have to take more pills to get the same effect of Viagra). If this sounds confusing, that's because it is, and it's ridiculous. Just to make myself clear, if a company wants to make a generic of Sildenafil, they have to go back through this entire development process by conducting research, submitting an ANDA, wait 48 months for approval or denial of the FDA, and then only sell it for treatment of cardiovascular diseases, because selling generic Sildenafil for erectile dysfunction would be in violation of patent laws. The crazy thing is that there are companies who already sell generic Sildenafil for cardiovascular treatment, but now there are eleven other pharmaceutical companies that have to also go through this entire process to release their generic versions of Sildenafil for erectile dysfunction treatment.

Obviously, Pfizer is not in any economic trouble since they are one of the "pharma giants" that will most likely never go bankrupt until every disease is cured; however, there are other economic factors that influence their ability to research new drugs that I have yet to bring up. These things include; 24% corporate income tax, government filing fees, payroll tax, expiring patents, merger fees, counterfeit drug sales, legal fees for protection of patents and etc. I also haven't mentioned that this process of FDA approval only approves the company to sell its drug in the United States. If Pfizer wants to sell any of its drugs in the European Union, it would have to go through a similar system of clinical trials and government approval, and the same thing would be applied to any country that Pfizer plans to expand it's market. All of this helps take a 2015 revenue of $49-$50 billion and reduces it to $9.5-$10.3 billion net profit for the company.

$10.3 billion may seem like a lot of money, but a lot of these profits will go right back into research and development for new drugs, and other profits will be re-invested into other projects. Regardless, the company has to make a yearly profit, and if it doesn't then it will go bankrupt. It would be devastating to allow a drug company that supplies many important pharmaceuticals to go out of business, since unless they decide to sell off their patents or royalty licenses (like they did with Teva and Viagra), production of their drugs will virtually cease to exist until the patent expires. If this event were to occur, they would either refuse to sell their patents, since it would end their monopoly on that method of treatment and the price of their drug would drop in order to compete with whatever new generic that would be made (meaning much much less revenue), or they would sell a patent for an outrageous price to try and make some kind of profit. Another option would be to liquidate their assets completely, but that could place the patents in the hands of companies that would feel fine jacking prices of drugs. Regardless, when a drug company sells a patent, the price of the drug increases (whether to price-gouge the consumers, or to pay back investors that contributed to buying the patent in the first place).

So now, if we think about this system of creating a new drug, one can imagine how impossible it must be for a new company to create a drug, and one can see how a company that specializes in treatments of rare diseases can be driven into bankruptcy by over-regulation. The FDA is a government-run bureaucracy that was created solely for the protection of the American citizen, but it has ruined the drug market. It's almost entirely responsible for the outrageous price increases seen over the past 20 years by making it so expensive just to create a drug, and by destroying competition between pharmaceutical companies. The argument that it is the pharmaceutical companies that are taking advantage of American citizens is rendered mute by the slow, incompetent, and increasingly expensive FDA. A good comparison of how the FDA is run would be to imagine one's local DMV, whether or not it is the best DMV in the world or the worst DMV in the world, and then imagining that same system of management controlling the entire drug market. The FDA may have started out with great intentions during its first couple of years, but just like any form of government it has grown so powerful and taken away so many freedoms of the market that drug prices will forever remain as high as they are until something incredibly significant happens.

Some would ask whether or not the FDA is needed at all. If there were no FDA, then most of the cost of research and development would be slashed, drugs could be made quicker; furthermore, the governments power to decide which drug is acceptable or unacceptable to be sold on the market would be left up to doctors, pediatricians, surgeons, and other healthcare practitioners.

Another quick point; the FDA also regulates anything that they would consider a "medical device" in a similar approval process to pharmaceuticals and biotech. Because of this, the cost of taking a device such as a stretcher from concept to the market can be around $24 million. With this outright diabolical price to get approval for medical devices, stretchers can end up costing $7,618, hospital beds costing $15,981, and operating tables costing $65,263. Even something as simple as a light or lamp can cost $27,306. Since hospitals also need to abide by FDA standards, that means that they will have to purchase many of these $27,306 lamps. Since they have to buy so many lamps they need to raise their prices, which means hospitals will charge you $93.50 for using a lamp during surgery.

The FDA has drastically increased the price of production for healthcare supplies and treatments, and when the cost of production goes up, the price of the product goes up. Normally, in a free market, this can be fixed since the company will naturally look for a cheaper alternative so that it can lower its price, or the market will naturally shift towards a different company that is selling a similar product at a cheaper price. The problem with the healthcare industry is that the FDA has made all of that illegal. Its allowed pharma companies to hold monopolies over drugs and biotech, forced the companies to raise their prices so that they can survive, and now it's trying to create a single payer healthcare system to supply these programs with what it believes would be an unlimited amount of money. If there were to be a single payer healthcare system, what would eventually happen is that the FDA would continue to increase restrictions on drug research and development and medical device development, those companies would continue to increase the prices of their products, hospitals will continue to price-gouge so that they too can afford the incredibly expensive equipment that they're required by law to use, and the single-payer healthcare system would have to keep giving more and more money to hospitals and pharmacies for treatments. The system would spin around and eventually implode in on itself.

The fact of the matter is that at the end of the day, any amount of government regulation in any market will naturally raise prices, whether for better or for worse. The ultimate joke of the entire situation is that the Affordable Care Act took away the freedom that the consumer has to remove himself from this vicious cycle by forcing all Americans to pay for healthcare coverage. In the past 20 years, most of the competition from the market has been removed, and ultimately the power that the consumer has to regulate the market has been stolen away by a socialist ideology. Socialist healthcare systems will ruin American healthcare in the exact same way that it either has or is currently everything else it is applied to.

Sources in order of Appearance:

- http://www.cbsnews.com/news/viagra-to-go-generic-in-2017-according-to-pfizer-agreement/

- http://www.fda.gov/Drugs/DevelopmentApprovalProcess/ucm079031.htm#What_is_the_difference_between_patents_a

- https://www.bloomberg.com/graphics/2016-drug-prices/

- http://www.forbes.com/sites/matthewherper/2013/08/11/how-the-staggering-cost-of-inventing-new-drugs-is-shaping-the-future-of-medicine/#3e18864d6bfc

- http://csdd.tufts.edu/news/complete_story/pr_tufts_csdd_2014_cost_study

- http://www.fda.gov/Drugs/DevelopmentApprovalProcess/HowDrugsareDevelopedandApproved/ApprovalApplications/InvestigationalNewDrugINDApplication/default.htm

- http://www.raps.org/Regulatory-Focus/News/2015/11/18/23635/What-FDA-Can-and-Can%E2%80%99t-Do-to-Help-Lower-Rising-Drug-Prices/

- http://www.forbes.com/sites/matthewherper/2013/08/11/the-cost-of-inventing-a-new-drug-98-companies-ranked/#72fdb1a51628

- https://www.pfizer.com/files/annualreport/2005/financial/financial2005.pdf

- https://www.gstatic.com/healthricherkp/pdf/pulmonary_hypertension.pdf

- https://www.google.com/patents/US5250534

- https://www.google.com/patents/US20090246298?dq=viagra+patent&hl=en&sa=X&ved=0ahUKEwi7oKLHic3RAhWFQiYKHcs4BuoQ6AEIHDAA

- http://www.raps.org/Regulatory-Focus/News/2016/03/10/24515/Teva-Wins-FDA-Approval-for-First-Viagra-Generic-Will-Not-Launch-Until-2017/

- http://www.pfizer.com/system/files/presentation/2015_Pfizer_Financial_Report.pdf

- http://medcitynews.com/2010/11/medical-device-makers-spend-millions-to-meet-fda-rules-study-finds/?rf=1

- http://www.modernhealthcare.com/section/technology-price-index

- http://www.rd.com/health/wellness/wildly-overinflated-hospital-costs/

No comments:

Post a Comment